Designing a whole new UX approach for debt collection

Have you ever received letters or calls from a debt collection agency because you forgot to pay an old debt? Were you feeling uncomfortable with the interaction because it lacked basic decency and respect? If both are yes, then you share this experience with Darren, one of the founders of DebtCo. He was triggered by this past negative experience and determined to join forces with Dylan, the other founders of DebtCo, to change the debt collection industry's climate with digital innovation.

When talking about debt collection, different people might associate it with different emotions and stereotypes, but mostly negative ones. For a creditor, naturally it is cumbersome trying to recover payments from debtors who are difficult to track down and likely not able to pay back on time. For a debtor, they could be unaware of the situation, or they are simply overwhelmed to repay the accumulated debts at once but at the same time addicted to this 'buy now pay later' habit. For the debt collection agencies, they have to work with massive amounts of sensitive personal and financial data in order to find the right clue to make the initial contact. This article presents how CollectIC as a debt collection application can help creditors, debtors, debt collection agencies in a positive, smart and efficient way.

At the beginning stage of the application development, we mapped out the current process of working on a debtor file together with all the user pain points. From there, the future process of working with CollectIC on a debtor file was established. This serves as the foundation of the application.

For creditors, they do not have to interact with CollectIC because the debt collection process is so smooth and efficient by using CollectIC.

For debt collection agencies who would like to use CollectIC, CollectIC offers three different user roles to suit the needs of different organisations, the administrator, the manager and the specialist. The administrator and specialist roles will be introduced here. DebtCo itself offers its service of collection by using CollectIC.

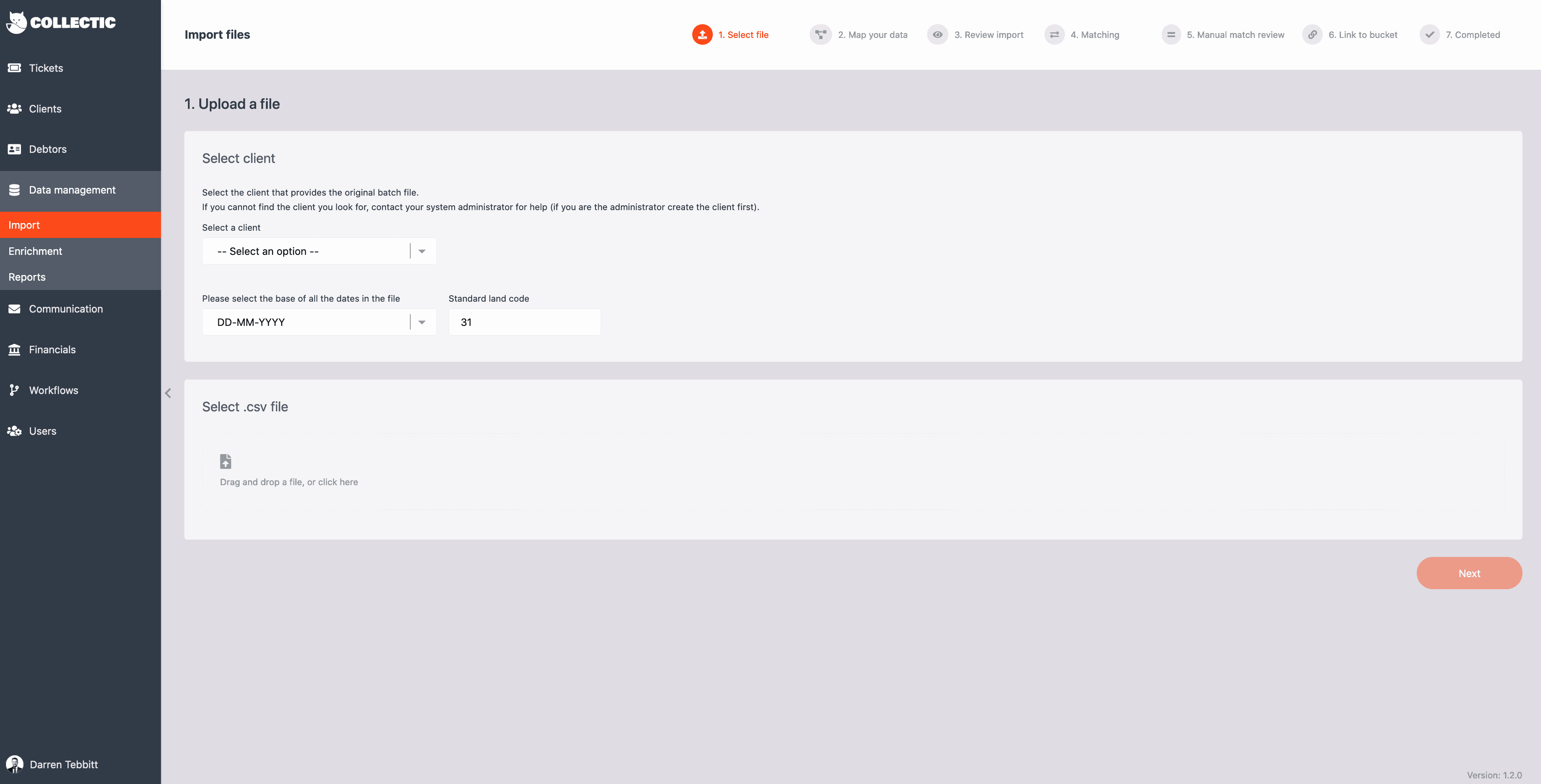

The work as an administrator of CollectIC, unlike the traditional administrator who has to spend a great deal of time handling many repetitive administrative works, is fun and trouble free. Thanks to the seamless data handling process, from import, diagnose, repair and match, CollectIC will guide the user step by step. The administrator can easily import and manage data within seven steps, then expect to see the clean and complete data set in the desired bucket. It is also possible to have the data value boosted with CollectIC data enrichment which can increase the chance of re-establishing contact and improving the recovery rate.

Another highlight for the administrator is to use the visual editor to build dynamic workflow that consist of a set of tasks and paths. This includes tasks like sending email, SMS, letter, phone calls, video messaging etc. The paths are made to connect the tasks in a chronological order.

The user can use the dynamic workflow to create automated communication. When analysing the current situation of working on a debtor file, the team discovered that there are several common workflows, such as the main workflow, the dispute workflow and the payment plan workflow. It obviously costs time and effort to train the specialists on what actions to take and when to take them. With the dynamic workflows, these workflows can be easily pre-configured by the administrator beforehand without needing any coding knowledge. There are standard workflow templates to get the user familiar with it, such as to send letters in the branded styling with an immediate email follow-up action. It is also quick and easy to build customised workflows with the visual editor by dragging and dropping different tasks on the canvas and connect them with a path. The administrator can save time and effort whilst the specialists can focus on the quality of the personal interactions with the debtors rather than the procedures.

As the debt collection specialist, working with CollectIC is motivating and enjoyable.

They can jump into every day's planned tasks straightaway and having all the tools they need within CollectIC. This way enables the specialist to act fast and deliver a more personalized experience. In fact, creditor can benefit from this too. A happier specialist can lead to a more positive interactions with the debtors. It prevents the debtors to associate any negative images with the creditors' brand. Therefore, the brand image is protected.

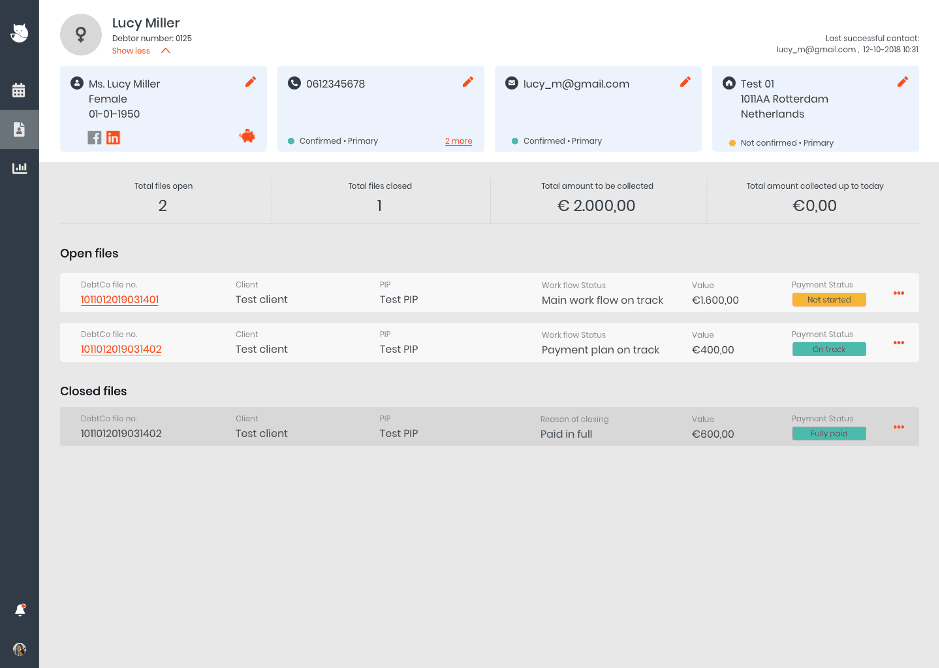

When a debtor initiates a contact with the specialist, the specialist can find out all the information about the debtor in a flash. They can immediately know the number of open files, total amount to be collected and whether there is payment plan or not in order to make the best possible strategy. If there is no payment plan made yet, the specialist can think along with the debtor to make a realistic payment plan which suits the debtor's situation. CollectIC supports multiple pay periods options in order to lighten the debtor's burden.

The specialists can contribute to the data set as well. They can easily see whether a communication channel is confirmed or not, any contact can feed the system with more accurate and up-to-date information.

For debtors, at the moment there is no direct interaction between them and CollectIC. But because of the carefully crafted application, debtors no long have to feel guilt and embarrassed with their debt situations. Debt collection specialists can help them to recognise the issues and find ways to solve them together.

The easily adjustable dynamic workflows together with a powerful data set make the work for CollectIC smoother and more efficient. In turn the debt collection agencies can have a better and more positive interaction with the debtors. Don't all these just make debt collection experience a positive one for everyone?

Reflection as a UX designer

At the beginning of 2019, I joined this exciting journey together with my Finaps colleagues and Darren & Dylan from CollectIC. We joined forces to define a positive debt collection application. It has been a unique opportunity for me to look into the debt collection process and be able to think along on how to improve it.

Overall it has been an explorative process to work on the project. For example, when I worked on the client view within the client management. Although the predefined functional map provided a good starting point, all detailed input fields and grouping of them came later after several rounds of discussions. For the import function, we knew what the import process was based on the process map and what the main steps were. But from the process map to high fidelity prototype was still a long to go. Eventually through many iterations and with the team effort, a user-friendly import process was implemented in CollectIC. Because of these discussions and iterations, CollectIC is easier and more user friendly, and thereby delivering a better end-user experience.

Another element that makes this project special to work on is that I was given all the freedom to think creatively and start from a completely white canvas. This is different from working for other projects which already have their existing visual guidelines and UI libraries. Although it is a B2B application, Darren set a high bar for the visual style. It is now part of the experience that CollectIC delivers to its clients and users. It is not only powerful function wise but also pleasant to work with.

About Huan

Part of the incredible team at Finaps, Huan is a user experience designer specialised in providing user centered design solutions for complex business problems